Posted On 6/20/23

Annual report spotlights solar asset management tools for addressing underperformance

Raptor Maps, the leading solar asset management software provider, is one of several industry leaders analyzing solar asset underperformance in kWh Analytics’ 2023 Solar Risk Assessment Report. The report provides wide-ranging insights into risks associated with the solar industry.

Contributors to the report focus on three key risk areas affecting solar asset underperformance: extreme weather, financial modeling, and operational concerns.

In addition to Raptor Maps, the report includes contributions from kWh Analytics, BloombergNEF, Clean Power Research, EnergySage, Envision Digital, ICF, NREL, PV Evolution Labs, RETC, and Wood Mackenzie Power & Renewables. The contributions highlight how solar asset management teams can identify and respond to power production risk scenarios.

The costs of solar asset underperformance

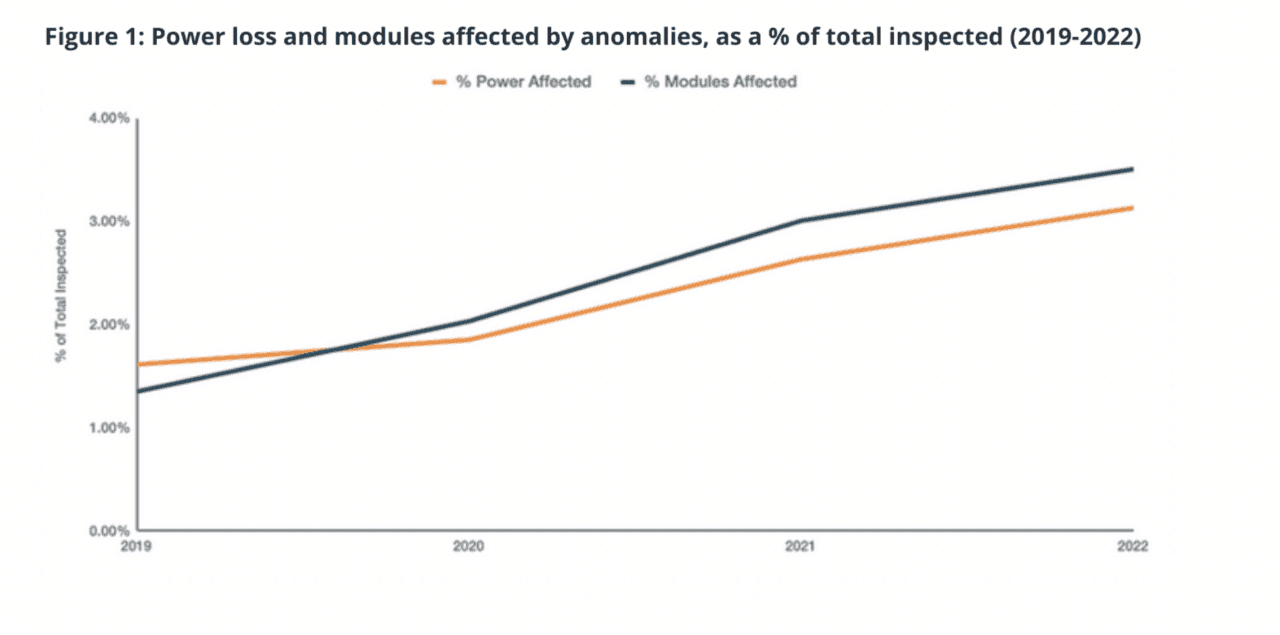

Raptor Maps’ contribution focuses on how solar asset underperformance costs the industry billions in lost revenue every year. Raptor Maps research notes that power loss due to equipment anomalies has increased by 94% since 2019 and posits that part of the solution to this revenue loss is better data management, which–in conjunction with robust analytic tools–ensures actionable insights.

UNLOCK MORE RESEARCH ON SOLAR ASSET UNDERPERFORMANCE HERE

How solar asset management can respond to extreme weather

Contributions to the report that focus on extreme weather include kWh Analytics’ finding that a proactive hail stow program can reduce property insurance premiums by up to 35% and RETC’s research showing that modules made from tempered glass are roughly two times as resilient to hail impact as those made with heat-strengthened glass.

Financial modeling of utility-scale solar risks

The section of the report about financial modeling risk includes a contribution from Wood Mackenzie Power & Renewables forecasting that capital costs for distributed generation (DG) solar will decline by 3% in 2023, and research from BloombergNEF positing that U.S. module prices will drop dramatically — under $.30 per watt — following upcoming tariff reductions.

Operational consequences of solar asset underperformance

The section of the report covering operational issues related to asset underperformance in utility-scale solar includes a piece from Envision Digital about how inverter efficiency derating can result in up to 2% production loss in desert climates and research from EnergySage noting that 44% of solar companies grapple with a lack of trained labor as a significant impediment to growth.

The report highlights the need for solar energy asset owners and operators to have reliable ways to identify and address anomalies affecting solar asset underperformance. Raptor Solar, Raptor Maps’ premier asset management platform, features geo-referenced digital twins of solar sites, offering actionable insights and advanced analytics to fuel asset management strategy, ultimately leading to greater power production and increasing rates of return.

READ MORE ABOUT HOW RAPTOR SOLAR SOLVES FOR SOLAR ASSET UNDERPERFORMANCE HERE

Contact us

Raptor Maps is building the digital foundation for a more resilient and scalable solar. From construction to end-of-life, we are your long-term software partners to ensure your sites are operating as expected and producing reliable energy to support the energy transition.